The U.S. Department of Energy’s Water Power Technologies Office enables research, development, and testing of emerging technologies to advance marine energy as well as next-generation hydropower and pumped storage systems for a flexible, reliable grid.

News

VIEW ALL

The U.S. Department of Energy named the acting director of the Water Power Technologies Office and is accepting applications until May 1 for the permanent director position.

April 16, 2024

Learn More

Today, the U.S. Department of Energy (DOE) announced renewed funding for the National Alliance for Water Innovation (NAWI), DOE’s energy innovation hub for desalination.

April 11, 2024

Learn More

Today’s hydropower plants can benefit from leveraging modern technologies. Read more to explore the answers to six questions about what hydropower modernization is, why it’s important, and how DOE is supporting this goal.

April 11, 2024

Learn More

WPTO has announced a notice of intent to fund programs that accelerate the commercialization and adoption of water power systems and solutions.

March 28, 2024

Learn More

This Women’s History Month, join the U.S. Department of Energy’s Water Power Technologies Office in celebrating the many women who are advancing water power.

March 25, 2024

Learn More

The Water Power Technologies Office opened applications for the 2025 Hydropower and Marine Energy Collegiate Competitions, which engage and educate students about real-world challenges facing these sectors and career opportunities in water power.

March 22, 2024

Learn More

The Water Power Technologies Office released its 2022–2023 Accomplishments Report, which showcases more than 40 hydropower and marine energy successes from projects at national laboratories, companies, and academic institutions across the country.

March 15, 2024

Learn More

The Water Power Technologies Office and the Oak Ridge Institute for Science and Education announced five students selected for the Marine Energy Graduate Student Research Program. They will work with mentors to advance their marine energy research.

March 13, 2024

Learn More

Jennifer Garson, the outgoing director of the Water Power Technologies Office, shares how saying “OK” to opportunities led her to working in clean energy and her thoughts on the important role water power plays in the clean energy transition.

March 12, 2024

Learn More

A new report from the National Renewable Energy Laboratory explores investment opportunities in hydropower.

March 8, 2024

Learn More

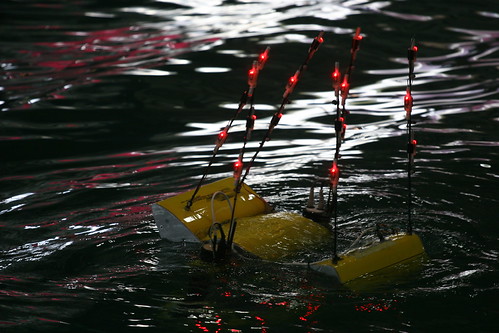

Water Power Images

Check out WPTO's water power image library to view images of hydropower and marine energy technologies.

Water Power Videos

Check out WPTO's water power video library to learn more about hydropower and marine energy technologies.

Subscribe to The Water Wire

The WPTO e-newsletter brings funding opportunities, events, publications, & activities related to hydropower and marine energy directly to your inbox.

Subscribe to Hydro Headlines

WPTO's Hydropower e-newsletter features news on R&D and applied science to advance sustainable hydropower and pumped-storage technologies.

Subscribe to The Water Column

WPTO's Marine Energy e-newsletter shares news and updates on tools, analysis, and emerging technologies to advance marine energy.

Water Power Events

May

09

Water Power Technologies Office Semiannual Stakeholder Webinar

12:30 PM to 2:00 PM EDT